An open letter regarding the investment policy in the Japan International Cooperation Agency (JICA), which is preparing to support for new coal-fired power projects

March 30 2022

Dear JICA Bondholders,

An open letter regarding the investment policy in the Japan International Cooperation Agency (JICA), which is preparing to support for new coal-fired power projects

Japan Center for a Sustainable Environment and Society (JACSES)

Kiko Network

Friends of the Earth Japan

350.org Japan

Mekong Watch

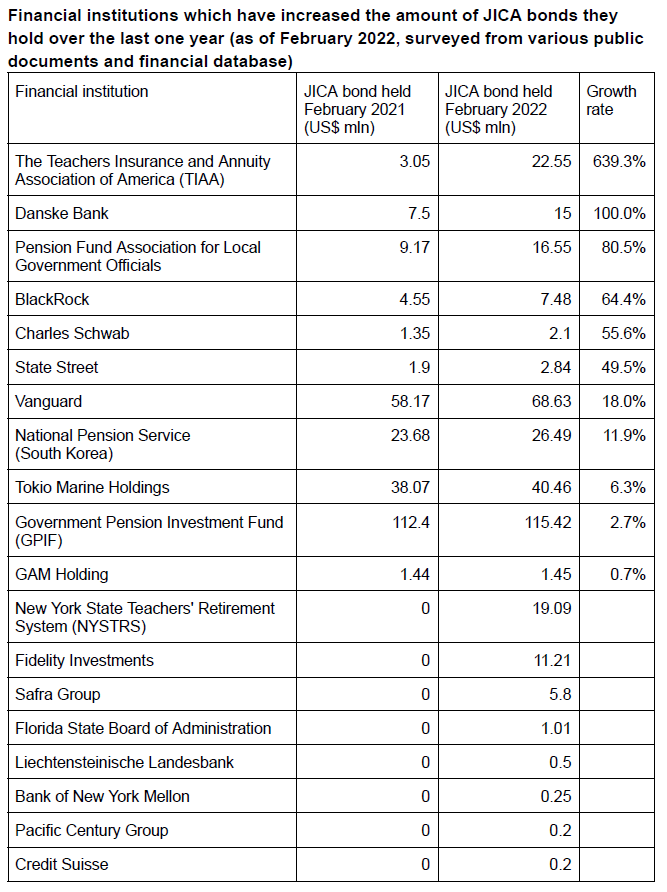

We, as environmental NGOs, have been requesting financial institutions that underwrite and hold bonds of Japan International Cooperation Agency (hereinafter referred to as JICA) , to engage with JICA, as well as to divest from, in order to stop JICA from financing new coal-fired power projects. We are sending this open letter to 19 financial institutions (listed below) that have apparently increased their possession of JICA bonds over the last one year.

JICA is preparing for financing the main construction of the Matarbari coal-fired power plant Phase 2 project (600MW x 2 units) (hereinafter referred to as Matarbari 2) in Bangladesh and the Indramayu coal-fired power plant project (1,000 MW x 1 unit) (hereinafter referred to as Indramayu) in Indonesia.

Meanwhile, according to the report “Net Zero by 2050, A Roadmap for Global Energy Sector” released by International Energy Agency (IEA) on May 18, 2021, the power generation sector needs to reach net zero GHG emissions globally by 2040 (*1). Thus, it is not consistent with the long-term goal of the Paris Agreement to support new coal-fired power projects such as Matarbari 2 and Indramayu.

Moreover, on June 13, 2021, G7 leaders announced an agreement to “commit now to an end to new direct government support for unabated international thermal coal power generation by the end of 2021, including through Official Development Assistance, export finance, investment, and financial and trade promotion support. (*2)” Supporting new coal-fired power projects is not consistent with this G7 commitment as well.

In addition, various problems have been pointed out for both projects, such as an excess supply of electricity and an increase in the financial burden of both countries, the lack of economic justification due to the ever-falling costs of renewable energy, and not fulfilling the requirements stated in JICA’s “Guidelines for Environmental and Social Considerations.”

JICA bonds are issued to contribute to the achievement of the Sustainable Development Goals (SDGs), set as one of the Japanese Government’s concrete measures to achieve the SDGs in the “SDGs Implementation Guiding Principles Revised Edition” (revised in December 2019). However, the above-mentioned two projects go against SDG Goal 13 (i.e. take urgent action to combat climate change and its impacts) and ignore SDG Goal 16 (i.e. to promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels).

In March 2021, 29 organizations from 12 countries submitted a letter (*3) to 39 Bond Underwriters and Bondholders of JICA, requesting them to urge JICA for cessation of financing both projects. As a result, we received replies from four financial institutions answering that they had engaged or were planning to engage with JICA and bond index providers.

In fact, between February 2021 and February 2022, nine financial institutions were confirmed to have reduced their JICA bonds or have divested: California Public Employees’ Retirement System (CalPERS), Resona Holdings, Japan Police Personnel Mutual Aid Association, Sumitomo Mitsui Trust Holdings, SMBC Group, Andra AP-Fonden (AP-2), Mizuho Financial Group, Lazard, and Nomura. On the other hand, we confirmed 19 financial institutions increasing their JICA bonds.

We would therefore like to ask your financial institution, who have apparently increased JICA bonds over the last one year, to answer the following questions. We would be grateful if you could send your answers to the following address by 30 April. Please note that we will publish your replies on our website.

[Questions]

1. Our survey has shown that the amount of JICA bonds held by your financial institution has increased over the last one year. Would you confirm

2. Is JICA’s attitude providing support for the projects that are inconsistent with the long-term goals of the Paris Agreement consistent with your investment policy?

3. Have you ever engaged with JICA regarding its support for coal-fired power projects? Also, do you have any plan to engage or divest in the future?

Footnotes:

※1: International Energy Agency (IEA), (2021), Net Zero by 2050, A Roadmap for the Global Energy Sector, p. 114, IEA, Paris, https://iea.blob.core.windows.net/assets/0716bb9a-6138-4918-8023-cb24caa47794/NetZeroby2050-ARoadmapfortheGlobalEnergySector.pdf

※2:https://www.mofa.go.jp/mofaj/files/100200009.pdf

※3:http://jacses.org/en/wp-content/uploads/2021/03/JICA-Bondholder-and-Underwriter-letter_2021.pdf

Contact: Yuki Tanabe, Japan Center for a Sustainable Environment and Society (JACSES)

Email: tanabe@jacses.org